Foundations Law: Regulation of Public Work Concessions, Infrastructure and Services

- Tenor of the concession: Concessions may be for a fixed or variable tenor, based on the required investment, operation and maintenance costs, debt services, among other factors.

- Enforcement Authority: Ministry of Economy.

- Public Services: Public service concessions or licenses will continue to be ruled by their regulatory frameworks, notwithstanding the application of this regime mutatis mutandis.

- Selection process: Concessions shall be awarded following a call for bids, locally and/or internationally.

- Budget earmarks: Budget earmarks are required, if government funds are required for the concession.

- Amendments to the Concession Contract – economic and financial balance: Unilateral modifications to the Concession Contract made by the grantor related to the execution of the project must be compensated to the concessionaire to maintain the economic and financial balance of the concession. Likewise, the renegotiation is allowed, having to prove, by means of technical reports, the convenience for the public interest and the due legal, economic and financial analysis of the execution of the contract to be renegotiated. The renegotiation shall be carried out within twelve (12) months from the date of economic and financial imbalance and may be extended by agreement of the parties.

- Unilateral termination of the contract: The unilateral termination of the contract for reasons of public interest must be declared by the National Executive Power, with the prior intervention of the Ministry of Economy.

- Dispute settlement: Disputes shall be resolved, primarily, through a technical panel. Arbitration is allowed as well.

***

For additional information, please contact Nicolás Eliaschev and/or Javier Constanzó.

Foundations Law: Private Initiative Regime

- Scope: The newly enacted Private Initiative Regime shall apply to public work contracts, public works, services and infrastructure concessions and PPP contracts.

- Enforcement authority: Ministry of Economy.

- Submission of Private Initiatives: Initiatives may be submitted (a) following a call for bids for projects considered to be of public interest; or (b) with no call for bids, in which case the promoter of the private initiative (the “Promoter”) shall provide substantiated reasons for the private initiative to be deemed as of public interest.

- Private Initiatives Information: The private initiatives shall detail the following information:

- Technical and financial background of the Promoter.

- Description of the project.

- Location, area of interest and related benefits.

- Estimated demand and associated annual growth rate.

- Analysis of the relevant legal aspects considering, among other factors, its area characteristics, implementation zone, and areas of interest.

- If applicable, a description of the works to be performed and/or services to be provided, with their technical analysis.

- Analysis of the technical, economic, and financial feasibility.

- Estimated CAPEX and OPEX.

- Analysis of the economic conditions associated to the contract, such as fees and tenor of the concession.

- Financing.

- Description of the most material risk factors related to the Private Initiative.

- Environmental impact studies.

The Privative Initiative shall be backstopped by a guarantee, in the form of an insurance bond or letter of credit, in a guaranteed amount equal to 0.5% of the estimated investment; provided, however, that this guarantee may not be required if the Promoter accredits that the guaranteed amount has been incurred in the preparation of the private initiative.

- Filing of the Private Initiative – Public Interest Declaration: The Enforcement Authority is enabled to request additional information or documentation, and shall have a term of sixty (60) days, extendable for the same term according to the complexity of the project, to prepare a non-binding report on the public interest and the eligibility of the proposal, considering its technical, economic and financial feasibility. If the Enforcement Authority considers that the proposal is as of public interest, it will submit the non-binding report to the National Executive Power, who will decide whether to grant such qualification or not, within a term of ninety (90) days, extendable for the same term according to the complexity of the project. If the initiative is rejected, the project Promoter will not be entitled to any compensation.

- Call for Bids: the call for bids shall be done within sixty (60) days following the declaration of public interest.

- Promoter’s Rights:

- The Promoter’s bid shall have priority with respect to other offers if the difference between each offer’s price is no greater than ten percent (10%). Tied parties shall have the right to improve their offers if the offered price’s difference is between ten (10%) and fifteen percent (15%).

- If the Promoter is not selected as the preferred bidder, the Promoter shall have the right to be reimbursed for the direct costs and expenses from the preferred bidder (such reimbursement will not exceed 1% of the bid, increasable to 3%).

- Assignment of rights to the private initiative is allowed for the benefit of the Promoter.

- Abrogation of Decree 966/2005: the prior Private Initiative Regime approved by Decree 966/2005 is abrogated.

***

For additional information, please contact Nicolás Eliaschev and/or Javier Constanzó.

Celulosa Argentina S.A.’s U$S3,699,506 Class 20 Notes and U$S11,300,494 Class 21 Notes Offering

Counsel to Celulosa Argentina S.A. in the issuance of 8.00% Class 20 Notes for U$S3,699,506 due February 8, 2026 Class 20 Notes are denominated and payable in U.S. dollars and 7.00% Class 21 Notes for U$S11,300,494 due February 8, 2026 Class 21 Notes are denominated in U.S. dollars and payables in Pesos, both under its U$S 150,000,000 Global Notes Program.

Banco de Servicios y Transacciones S.A., Puente Hnos. S.A., Balanz Capital Valores S.A.U., Zofingen Securities S.A., Invertironline S.A.U, Banco Supervielle S.A., Facimex Valores S.A., and GMC Valores S.A. acted as placement agents of the Notes. Banco de Servicios y Transacciones S.A. and Puente Hnos. S.A. acted as arrangers of the issuance, and Banco de Servicios y Transacciones S.A. also acted as settlement agent of this issuance.

Regulation of Foundations Law: Government reorganization and Sale of state-owned companies

On August 5, 2024, the Government released Decree 695/2024 (the “Decree 695”) that regulates Title II “State Reform” of Law 27,742 “Foundations Law” (“Ley de Bases y Puntos de Partida para la Libertad de los Argentinos”).

A summary of the most relevant aspects on the regulations related to Government reorganization and Sale of state-owned companies are described below. Additional comments to the Foundations Law on these subjects are also available here and here.

1. Government reorganization

The Ministry of Economy shall propose to the National Executive Power the modification, transformation, unification, liquidation or dissolution of public trust funds in accordance with Section 5 a), b) and c) of Law 27,742 and other applicable provisions.

In addition, Decree 695 empowers the Ministry of Economy to issue complementary regulations to implement this procedure.

2. Sale of state-owned companies

2.1. Report

For the purposes of obtaining the National Executive Power’s authorization to proceed with the sale of state-owned companies, the Ministry or Secretary in control of the respective state-owned company (list that includes ENARSA, AYSA, Belgrano Cargas, Intercargo, Corredores Viales, among others) must submit to the National Executive Power a detailed report with a specific proposal of the most adequate procedure and modality for the sale of such any state owned company (the “Report”), after the intervention of the Agency for the Transformation of State-Owned Companies (Agencia de Transformación de Empresas del Estado).

2.2. Call for bids

Call for bids shall be published for, at least, seven (7) days, and the last publications shall be made, at least, thirty (30) days prior to the deadline for the submission of bids, according to the complexity of the procedure. Additionally, the call for bids must be published on the website of the enforcement authority responsible for the procedure.

For international call for bids, the call also must be published in at least one website that allows adequate access to foreign interested parties, for a term of three (3) days, at least forty-five (45) calendar days prior to the deadline for the submission of bids. The enforcement authority may also issue invitations to participate to all those human or legal persons, with national or foreign capital, that considers convenient.

2.3. Liquidation

In the case of sale of the above mentioned companies when the transfer of contracts under execution to the provinces is required, the Report shall also detail the amounts involved in any such contract, as well as any related agreements.

The company in liquidation, in cooperation with the Agency for the Administration of State Assets (Agencia de Administración de Bienes del Estado) must elaborate an inventory of its assets, including their valuation. If applicable, a priority order for the sale of the assets must be defined.

2.4. Other provisions

Prior to the closing of contracts, the Office of the Attorney General (Procuración del Tesoro de la Nación) and the Agency for the Transformation of State-Owned Companies may make observations and/or suggestions. In that event, the enforcement authority shall perform the referred modifications, and submit a final report to the National Executive Power for its approval. Once the procedure is completed, the enforcement authority shall draft a final report to the General Auditor Office.

***

For additional information, please contact Nicolás Eliaschev and/or Javier Constanzó.

Legal Advice in Petrolera Aconcagua Energía S.A.’s Class XII Note Issuance

Counsel in the issuance of Petrolera Aconcagua Energía S.A.’s 2.00% Class XII Notes, for US$ 25,023,948 issued on July 18, 2024, and due July 18, 2026, under its US$ 500,000,000 Global Notes Program.

Banco de Servicios y Transacciones S.A., acted as arranger and placement agent, and Banco Mariva S.A., Banco Supervielle S.A., Banco Santander Argentina S.A., Banco de Galicia y Buenos Aires S.A.U., SBS Trading S.A., Consultatio Investments S.A., Allaria S.A., Adcap Securities Argentina S.A., Facimex Valores S.A., Balanz Capital Valores S.A.U. and Invertir en Bolsa S.A., acted as placement agents.

Legal Advice in the Issuance of Series XIV Notes of MSU S.A. for US$ 33,500,000

Counsel to Banco de Galicia y Buenos Aires S.A.U. as arranger, placement agent and settlement agent, and Balanz Capital Valores S.A.U., Banco Santander Argentina S.A., Banco de Servicios y Transacciones S.A., Puente Hnos. S.A., Banco de la Ciudad de Buenos Aires, and Adcap Securities Argentina S.A. as placement agents, in the issuance of MSU S.A. 7.50% Series XIV Notes for US$ 33,500,000 issued on July 23, 2024, and due July 23, 2027, under its US$ 200,000,000 Global Notes Program.

Banco de Galicia y Buenos Aires S.A.U. acted as arranger, placement agent and settlement agent, and Balanz Capital Valores S.A.U., Banco Santander Argentina S.A., Banco de Servicios y Transacciones S.A., Puente Hnos. S.A., Banco de la Ciudad de Buenos Aires, and Adcap Securities Argentina S.A. acted as placement agents.

Foundations Law: Labor Reform

1. Promotion of registered employment

Employers may regularize, within 90 days as of the regulation of the Foundations Law, the labor relations that are not registered or were registered in a deficient or partial manner (lower remuneration or date of entry after the real one).

The regulation of the law will precisely define the effects of this regularization, which in principle would include: (i) the extinction of the criminal action in process and the remission of fines for infractions; (ii) the removal of the employer from the registry with labor sanctions (“REPSAL”); (iii) the remission of debts of withholdings and contributions (except health care regime) in no less than 70% of the total; including those that are in dispute in a court of law.

Workers whose contracts have been regularized within the framework of the law and its regulations, will be entitled to compute, only for the purposes of the payment of the Universal Basic Benefit ("PBU") and for Unemployment Benefit, up to 60 months of services with contributions, calculated on the amount of the minimum, vital and mobile salary.

2. Labor modernization

Under this heading, the Foundations Law produces a very significant labor reform over the Employment Contract Act (“ECA”) and other labor regulations; the most important guidelines of which are as follows:

2.1. Repeal of fines for irregular registration

The Foundations Law eliminates all provisions of the National Employment Law No. 24,013 which set fines for lack of registration or deficient registration of the employment relationship. Law No. 25,323, which imposed fines for irregular registration (Section 1) and for failure to pay severance payments for dismissal without cause (Section 2) are also repealed by the Foundations Law.

2.2. Elimination of fines for failure to deliver work certificates

Through the repeal of Sections 43 to 48 of Law No. 25,345, the fines related to the failure to deliver the certificates of services and remunerations (Section 80 ECA) and for failure to pay the contributions withheld from the worker (Section 132 bis ECA) are eliminated.

2.3. Registration of the employment contract

There will be a new mechanism for the registration of the employment relationship, to be defined by the regulations, which will be simple and electronic. There will also be a simple mechanism for the issuance of salary slips and a unified contribution will be provided for companies with up to 12 workers.

2.4. Contractors and intermediaries

The law sets out the validity of the registration made by the original employer in relationships with contractors and staffing agencies. In the same sense, due to the amendment of Section 29 of the ECA, it is established that workers hired by third parties to be assigned to companies will be considered direct employees of the company which register the relationship, thus eliminating the risk of irregular registration of workers assigned to companies by third party contractors.

2.5. Deficient Registration

The worker may denounce the lack or partial registration of the employment relationship before the AFIP, through the electronic means that the authority will offer for such purposes. If such deficiency is established by the Court, the Judge will report the AFIP, which will determine the relevant social security debts. The corresponding debt will consider the contributions paid by the independent contractor.

2.6. Scope of application of the ECA

Service and agency contracts (among others) regulated by the National Civil and Commercial Code are excluded from the scope of application of the ECA.

2.7. Presumption of employment contract. Civil contracts

Professional services or trades that foreseen the issuance of official invoices by the provider do not fall under the presumption of the existence of an employment contract when the services are rendered by individuals. This understanding extends its effect to Social Security obligations.

2.8. Trial period

The trial period (Section 92 bis ECA) is of 6 months. This period may be extended by collective agreements to 8 months in companies with 6 to 100 workers, and up to 12 months in companies with a payroll of no more than 5 workers. These provisions will also apply to the national agricultural labor regime.

2.9. Pregnancy protection

The prohibition for pregnant women to work during the 45 days before and after childbirth is maintained, although as a result of the reform the employee is granted the option to reduce the pre-birth leave to 10 days, accumulating the remaining period to the postpartum period.

2.10. Just cause for dismissal

The law amends Section 242 of the ECA, expressly including as causes for dismissal, the following: (i) active participation in blockades or takeovers of the establishment; (ii) when as a result of the participation in strikes, (a) the freedom to work of those who do not participate in the strike is affected; (b) the entry of persons or things to the establishment is obstructed; (c) damage is caused to persons or assets of the company or third parties. Before dismissal because of these non-compliances, the employer must formally request the worker to abandon his attitude. This request is not necessary in the case of damage to persons or things.

2.11. Special compensation for discriminatory dismissal

Judges may increase the severance compensation between 50% and 100% (depending on the seriousness of the discriminatory act) in cases where the employee proves before Court that his/her dismissal was motivated by reasons of ethnicity, race, nationality, sex, gender identity, sexual orientation, religion, ideology or political or union opinion. Despite the discrimination scenario, the employee will not have the right to claim reinstatement.

2.12. Severance fund

Within the framework of a collective bargaining agreement, the parties may replace the current severance payment scheme with a "severance fund ". Its characteristics will be defined by the regulations. On the other hand, employers may choose to contract a private capitalization system (or self-insure) to cover the cost of the severance indemnification provided by the ECA or for the payment of a bonus agreed within the framework of mutual termination agreement.

2.13. Independent worker with collaborators

The Foundations Law incorporates a new category of self-employed workers, providing that an autonomous worker may work with up to 3 self-employed workers to carry out a productive undertaking, under a special regime to be regulated by the National Executive Power. There will be no employment relationship between those parties, unless in the reality of the relationship the notes of subordination that characterize any relationship of dependency are visualized. Anyway, as per the conditions to be defined by regulations, these workers will be included under the Social Security regimen, Health Care, and the Labor Hazards Law.

***

For additional information, please contact Federico Basile.

Law on Palliative and Relevant Tax Measures

On June 28th, 2024, the National Chamber of Deputies finally passed the Law on "Palliative and Relevant Tax Measures" (the "Tax Measures"), rejecting the amendments introduced by the National Senate on Income Tax (for employees) and Personal Assets Tax.

Below, we summarize the most relevant aspects of the Tax Measures:

Exceptional Regularization Regime for Tax, Customs, and Social Security Obligations (“moratorium”)

- Included obligations: the moratorium applies to tax, customs, and social security obligations (with some exclusions) due by March 31, 2024, inclusive, and for infringements committed up to that date, whether related to those obligations or not.

- Compensatory and punitive interests forgiveness: the moratorium establishes the following scheme for interests forgiveness: a) 70% of forgiveness if the payment is made in cash or through a payment plan of up to 3 monthly installments, and the adherence to the moratorium takes place within the first 30 calendar days from the issuance of the regulation by the Tax Authorities (hereinafter, the “AFIP”, as per its acronym in Spanish); b) 60% of forgiveness if the payment is made in cash or through a payment plan of up to 3 monthly installments and the adherence to the moratorium takes place from the 31st to the 60th calendar day; c) 50% of forgiveness if the payment is made in cash or through a payment plan of up to 3 monthly installments and the adherence to the moratorium takes place from the 61st calendar day to the 90th calendar day; d) 40% of forgiveness if total debt is regularized through a payment plan and the adherence to the moratorium takes place within the first 90 calendar days; e) 20% of forgiveness if the total debt is regularized through a payment plan and the adherence to the moratorium takes place after the 91st calendar day.

- Financing: for cases d) and e) mentioned above, it is established that: (i) individuals must make a prepayment of 20% of the debt and they are allowed to pay the remaining amount in up to 60 monthly installments; (ii) Micro and Small Enterprises must make a prepayment of 15% of the debt and they are allowed to pay the remaining amount in up to 84 monthly installments; (iii) Medium Enterprises must make prepayment of 20% of the debt and they are allowed to pay the remaining amount in up to 48 monthly installments; (iv) other taxpayers must make a prepayment of 25% of the debt and they are allowed to pay the remaining amount in up to 36 monthly installments. In all cases, future regulations will set a financing interest, which will be calculated according to the rate established by the Banco de la Nación Argentina for commercial discounts.

- Other benefits: the adherence to moratorium implies the forgiveness of 100% of fines and the extinction of criminal actions.

Asset Regularization Regime (“Tax amnesty”)

- Subjects: (i) individuals, undivided estates, and companies that, as of December 31th, 2023, are deemed Argentine tax residents, whether or not they are registered as taxpayers before AFIP; (ii) individuals who were Argentine tax residents before December 31th, 2023, but have lost such status by that date. If latter adhere to the Tax amnesty, they will be deemed Argentine residents as of January 1st, 2024.

- Adherence period: the referred subjects can adhere to the Tax amnesty up to April 30th, 2025. The National Executive Branch may extend this period until July 31st, 2025.

- Included Assets: assets located in the country and abroad, including national and foreign currency, movable and immovable property, securities and shares, credits and rights, cryptocurrencies (only as assets in the country) owned, possessed, hold, or custodied by the taxpayer as of December 31st, 2023.

- Special tax: the special tax rate will be 5%, 10%, or 15%, depending on the moment in which the tax return is filed, and the payment is made.

- Amnesty without special tax: subjects will be able to regularize up to USD 100,000 without any penalty. If the amount subject to amnesty exceeds USD 100,000, no penalty will apply if the funds remain in a special account until December 31st, 2025. Amounts deposited in the special account can be invested in certain financial instruments specified by the regulation.

- Benefits: (i) extinction of all civil or criminal actions derived from the non-compliance of obligations related to the regularized assets; (ii) tax and interest forgiveness; (iii) inapplicability of the unjustified wealth increase presumption.

Personal Assets Tax ("PAT")

Special PAT Prepayment Regime: Tax Measures include an optional and voluntary prepayment regime for PAT, which has the following characteristics:

- Subjects: (i) individuals and undivided estates that, as of December 31st, 2023, are deemed Argentine tax residents; (ii) individuals who were Argentine tax residents before December 31st, 2023, but lost such status by that date. If they adhere to this Regime, they will be deemed Argentine tax residents again.

- Adherence period: subject will be able to adhere to this regime up to July 31st, 2024. This period may be extended up to September 30th, 2024.

- Included tax periods: 2023 to 2027 (unified) or 2024 to 2027 (unified) in case of taxpayers that have adhered to the Tax amnesty.

- Calculation method: PAT tax base is determined by considering the taxpayer's assets as of December 31st, 2023 -with certain particularities- multiplied by 5.

- Tax rates: the following rates are applied: (i) individuals and undivided estates: 0.45%; (ii) taxpayers who have regularized assets under the Tax amnesty: 0.50%. Since tax period 2028, maximum tax rate will be 0,25%

- Initial payment: taxpayers adhered to this regime must make an initial prepayment of -at least- 75% of the total PAT determined according to the regime's rules.

- Benefits: (i) exclusion from the payment of PAT and any other wealth tax for the tax periods 2023 to 2027 (or 2024 to 2027, as the case may be); and (ii) tax stability on those taxes up to 2038.

PAT Law:

- Certain modifications are established for the tax period 2023.

- The PAT non-taxable minimum is modified: ARS 100,000,000 (or ARS 350,000,000 for real estate that qualifies as only residence).

- The Tax measures include the unification of PAT rates for assets located in the country and assets located abroad as follows:

- Tax period 2023: from 0.50% to 1.50%;

- Tax period 2024: from 0.50% to 1.25%;

- Tax period 2025: from 0.50% to 1%;

- Tax period 2026: from 0.50% to 0.75%;

- Tax period 2027: a single rate of 0.25%.

- The Tax measures include benefits for compliant taxpayers:

- To qualify as a compliant taxpayer, the taxpayer (i) must not have regularized assets under the Tax amnesty; and (ii) must have submitted the PAT returns related to tax periods 2020 to 2022, inclusive, in a timely and proper manner, and must have fully paid, before December 31st, 2023, the PAT due to the AFIP resulting from each of those tax returns.

- Compliant taxpayers will have a 0.50% reduction in the PAT rates for tax periods 2023 to 2025.

Income Tax ("IT")

- The Tax measures repealed the “cedular IT” previously applied to employees, which established a special and unique deduction equivalent to 180 annual minimum salaries for IT determination.

- In replacement, it is created a new regime to determine employees’ IT.

- This new regime repeals certain exemptions, deductions, and benefits previously applicable to employees.

- Certain personal deductions are reinstated.

- Non-taxable minimums, scales, and personal deduction amounts are updated.

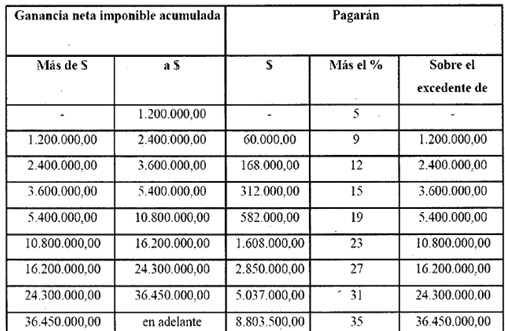

- The following scale is established for employees’ IT determination:

- From 2025, scales will be adjusted for inflation every semester (in January and July of each year) based on the CPI (Consumer Price Index).

- An exceptional adjustment for inflation will take place in September 2024, regarding months June to August. Therefore, the amounts corresponding to the first half of the current year will not be adjusted.

- The National Executive Power is authorized to exceptionally increase deductions during 2024.

-

Other modifications

- The billing caps of the Simplified Regime for Small Taxpayers were updated. The National Executive Power is authorized to increase those caps during 2024.

- The Real Estate Transfer Tax (“ITI”) was repealed.

- A tax transparency regime for consumers was created.

-

***

For additional information, please contact Gastón Miani or Leonel Zanotto.

Foundations Law: Electric Energy

The National Executive Power is entrusted, for a term of one (1) year, to make amends to the electric energy regulatory framework, namely composed by Laws No. 15,336 and No. 24,065, in order to guarantee, among others, free international trade of electric energy; free commercialization and expansion of the electric energy markets; the adjustment of the fees of the energy system based on the real costs of the supply, to cover investment needs and guarantee the continuous and regular provision of public services; and the development of electric energy transportation infrastructure.

Common regulations on electric energy and natural gas chapters

Appeals and objections to sanctions

Acts and sanctions issued by the highest authority of the regulatory body may be challenged without the need to file an appeal, directly before the National Court of Appeals for Federal Administrative Matters.

Unification of regulatory bodies

Foundations law unifies the electricity and gas regulatory bodies under a single entity, the “Ente Regulador del Gas y la Electricidad”.

***

For additional information, please contact Nicolás Eliaschev and/or Javier Constanzó.

Foundations Law: Sale of state-owned companies

The Foundations Law declares subject to sale the following state-owned companies:

- Energía Argentina S.A.

- Intercargo S.A.U.

- Agua y Saneamientos Argentinos S.A.

- Belgrano Cargas y Logística S.A.

- Sociedad Operadora Ferroviaria S.E. (SOFSE)

- Corredores Viales S.A.

Nucleoeléctrica Argentina Sociedad Anónima (NASA) and Complejo Carbonífero, Ferroviario, Portuario y Energético a cargo de Yacimientos Carboníferos Rio Turbio (YCRT) equity interests will be subject to sale as well, to the extent that the National Government retains a majority stake, and a private ownership (PPP) program for the employees is set up.

***

For additional information, please contact Nicolás Eliaschev and/or Javier Constanzó.